Grow Your Co-op

Whether your co-op is at an early stage or a long-established business planning for expansion, one of the biggest challenges is the "Sources" side of your statement of Sources and Uses of capital. Where will the money come from? What are the implications of different sources of funds? Is capital from some sources easier to raise than from others? Can you avoid being under-capitalized?

This article explores a number of the more commonly used sources of capital for co-ops, looking at risks and benefits and noting other aspects worth keeping in mind. This is not an exhaustive list—new programs can appear at any time, and there are also many variations from state to state and regionally. It is strongly recommended that co-ops use qualified consultants, including legal and accounting help, when planning a capital campaign.

Members as owners

The best form of capital comes directly from the owners. Why? Investment opportunities in our co-ops are another way co-ops can serve their members, and that is why our co-ops exist.

For larger investors, this is an opportunity to put money into a valued local institution and do so without the overhead associated with conventional investments. For others, the relatively low initial dollar amount puts investing within reach of folks of quite modest means.

Capital from owners usually has the lowest interest or dividend burden on the co-op, compared to bank or credit union loans.

Owner investment is evidence that owners support the co-op and its vision and values and are willing to put their money at risk in that belief.

Capital from owners helps leverage external capital (from credit unions, banks, and other sources).

Capital from owners can come from increased equity, owner loans (often referred to as "member loans"), or preferred shares, and/or an "angel" investor. Some capital from owners, especially preferred shares, will be accounted for as equity on a co-op’s balance sheet.

Increased equity also can be achieved through raising the cost of ownership shares and by increasing the number of owners. Many co-ops have raised their ownership investment in order to move from the extraordinarily low figures of the past to a more meaningful amount, ranging from $100 to $300. Raising the ownership share cost of an existing co-op can be an involved process and generally doesn’t yield a large increase in capital for the effort expended, but the shift can be important for a co-op planning for ownership growth.

Increasing the number of owners can also require significant effort for a relatively modest increase in capital. But ownership growth has the additional benefits of potentially increasing sales and demonstrating support for the co-op or its project. Particularly for startups, there are no downsides to having more owners. Owner loan and preferred share campaigns also benefit directly from increases in the number of owners, since it typically is challenging to get greater than 20 percent of a co-op’s ownership involved in those investments.

Owner loan and preferred-share campaigns can raise a significant amount of capital and, particularly for startups, can be key factors in the success of a project. Because of the correlation between the number of owners and number of investors, a successful loan or preferred-share campaign can indicate healthy ownership levels and strong community support for a new co-op or for an expansion project. These investment vehicles can also be used without security or collateral, leaving the co-op’s assets available to secure the "first-position"portion of financing.

For startups that have no financial history, owner loans have specified payback schedules and interest rates and may be easier to sell compared to preferred shares. Preferred shares may pay annual dividends but do not have payback schedules associated with them, so they can provide long-term financing for a co-op with payback at the discretion of the board, based on the co-op’s financial strength. Both of these investment methods require significant effort to be successful and may create a burden on the staff of operating co-ops—during the campaigns and in the future because of the large number of relatively small investments to be tracked and the associated paperwork. Because of this, owner loan and preferred-share campaigns seem to have a natural limit of roughly $1.5 million or 250 investments.

Preferred shares are usually recorded as equity on a co-op’s balance sheet. Even though they are technically debt, owner loans may be viewed as equity by some lending institutions, affecting debt-to-equity ratios.

One or more large "angel" investors, either in the first position or as additional investment, can be advantageous, but they also can be hard to find and can have risks. Even small communities have people of means who may be interested in a local investment that reflects their values or who want to be associated with a project like a new or expanding co-op.

A desire to have control or influence in proportion to the investment size can be a factor. Educating these potential large investors and making sure agreeable lending agreements are drafted and fully approved by legal counsel for both sides is essential. Friendly City Food Co-op in Harrisonburg, Va., secured $584,600 of first-position financing through a loan from one owner after an appeal was made at an annual owners’ meeting for assistance with principle financing.

As with attempts to generate capital from any source, sound financial projections, systematic project planning, and clear understanding and articulation of the co-op’s financial needs are essential to attract angel investors. Angel investment, even if from a member of the co-op, typically falls outside the owner loan program.

External lenders

Credit unions can also be great partners for raising co-op capital. As fellow cooperative institutions, they subscribe to the cooperative principles. They are easily identifiable (unlike angel investors) and tend to be driven by a desire to build financial and business success in their operating areas.

Establishing a relationship between a food co-op and a credit union can yield numerous benefits beyond access to project capital. Lines of credit for operations, cross-sector collaborations, joint marketing, and access to credit union owner communications can be beneficial for food co-ops. In October 2012, the Credit Union National Association (CUNA) released a white paper on how credit unions and cooperatives can cooperate more effectively, so attention is being paid to co-ops and credit unions working together.

Cooperative development funds such as Northcountry Cooperative Development Fund (www.ncdf.coop), the Cooperative Fund of New England (www.cooperativefund.org), and the Local Enterprise Assistance Fund (leaffund.org) are also potential lenders, either in first or subordinated position. They provide the potential for large amounts of capital from a single source and are focused on cooperative success. They can also provide business advice and other benefits similar to credit unions.

Local and community banks are not driven by cooperative principles but in some cases can provide resources and benefits similar to credit unions and also have local decision-making. They may have substantial financial resources to draw from and may be interested in being associated with community-oriented institutions like food co-ops.

The National Cooperative Bank (www.ncb.coop) has been involved in transactions with successful established food co-ops, often involving real estate purchases. NCB has been a long-time supporter of the food co-op sector.

The USDA has a number of business programs aimed at serving rural development and agricultural needs. Even if your co-op is in an urban area, there may still be applicable programs based on food co-ops’ proven commitment to sustainable local and regional agriculture. These programs include loans, grants, and guarantees, often in partnership with private-sector lenders. USDA programs can be complicated, time-consuming, and expensive when navigating the paperwork and requirements, but there are significant funds available. The Co-op Market in Fairbanks, Alaska, achieved some of its startup financing through the Rural Economic Development Loan and Grant (REDLG) program. USDA has rural development offices and representatives who cover the entire country and also has a list of Cooperative Development Centers on its website (www.rurdev.usda.gov/LP_CoopPrograms.html).

Grants and donations can be sources of limited amounts of capital. All kinds of grants exist, but it can be challenging and time-consuming to find which grants may apply to your co-op’s situation. It may be helpful to contact local and regional economic development offices, since they may be aware of grant opportunities applicable to the location and plans of a particular co-op. Donations can be problematic since co-ops are generally not qualifying nonprofit institutions that can receive tax-deductible donations. Separate sister organizations that are nonprofits can be created, but usually funds can be accepted only for specific educational or charitable uses, not general cooperative development. Non-tax-deductible donations can be accepted but are considered income and thus are taxable. Charitable organizations can serve as fiscal agents, able to receive tax-deductible donations, which will then be donated to a co-op, sometimes with a percentage retained by the organization and often with specific parameters around the use of funds.

National banks have vast amounts of money to lend but often with challenging terms, collateral requirements, and little local decision-making. They provide none of the benefits of local credit unions or banks, but may be worth pursuing if other local options have been ruled out and a good relationship between a national bank and your co-op exists or can be created.

"Do-gooder" funds is my term for charitable lending institutions that offer loans to organizations such as co-ops that are dedicated to building community and improving the environment or peoples’ lives. Some of these are referred to as "creative community" funds or conservation funds. Although loan sizes are relatively small ($25,000 to $100,000), these institutions can be more flexible with collateral requirements and can be worth exploring to complete an overall financing package.

Your community may have more sources of capital than I’ve noted here. Networking and establishing strong relationships with your local and state governments, lenders, and charitable organizations can help you uncover more sources of capital for your co-op. Do your planning, create sound financials, go raise some capital, and grow your co-op!

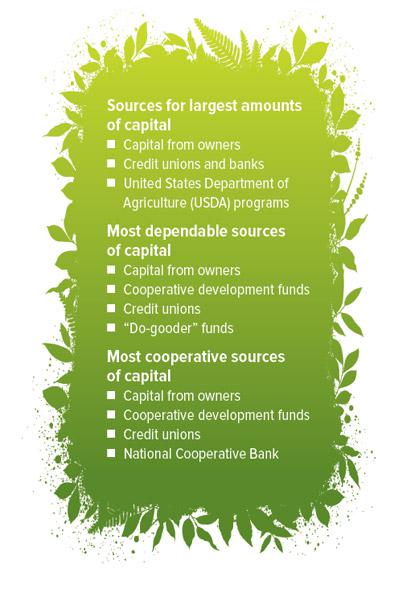

Sources for largest amounts of capital

- Capital from owners

- Credit unions and banks

- United States Department of Agriculture (USDA) programs

Most dependable sources

of capital

- Capital from owners

- Cooperative development funds

- Credit unions

- "Do-gooder" funds

Most cooperative sources

of capital

- Capital from owners

- Cooperative development funds

- Credit unions

- National Cooperative Bank