$3 Billion in Sales by 2020 — What Does It Take?

The 109 member co-ops of the National Cooperative Grocers Association (NCGA) currently generate annual sales of $1 billion. NCGA believes that growing the sector’s market share will result in an increase in prominence and relevance within the industry and among the public. Toward that end, NCGA has set a goal of $3 billion in sales by year 2020.

In terms of the simple math, tripling today’s sales by 2020 means achieving sustained annual sales growth of 10 percent. Although we’ve historically enjoyed double-digit growth rates, our growth has slowed over the past two years and is currently about 8 percent overall. This lower rate of growth will only get us to $2.5 billion by 2020. Chart A, below, indicates the declining rates of sales growth for both our co-ops and Whole Foods.

There is some concern within our sector that it will be difficult for us to maintain 8 percent annual growth due to increasing competition from both the natural and conventional retail food channels. The current weakening economy is also of concern; Whole Foods reported same store sales growth of less than 3 percent during their most recent quarter and a 30 percent decline in net income during the period.

If we are able to maintain our current growth rate and we also add 100 new stores over the next 12 years (each opening with average annual sales of $4 million and maintaining 8 percent growth), we then can achieve $3 billion in sales by 2020. Since over 40 percent of NCGA members reported expansion and new store activity in a recent survey, adding 100 stores over the next 12 years may be feasible.

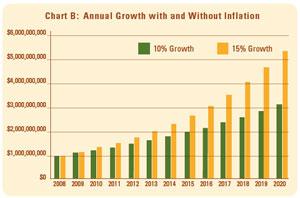

The picture looks much different if we consider $3 billion in today’s dollars. If we assume an annual food inflation rate of 5 percent, then today’s $3 billion is approximately $5 billion by 2020. This will require sustained annual sales growth of 15 percent-a growth rate that appears to be difficult to achieve. The chart below (Chart B) indicates the dramatic difference in these goals when we consider inflation.

It seems clear that if sales growth is seen as a means to achieve greater relevance and prominence for co-ops within our industry and among consumers, then we must factor inflation into the equation. Today’s $1 billion in sales represents approximately 4 percent of the natural food retail market. Inflation raises everyone’s sales, so it is likely that sales of $3 billion in 2020 will represent a decline in co-ops’ market share.

Higher rates of food inflation need not be problematic for our cooperative business. If we consider the rising value of our inventory as a positive factor and we take advantage of our ability to purchase “extra” inventory in advance of price increases, we are able to leverage inflation to our advantage. This requires diligent attention to our supply chain, but a long-used phrase in the conventional grocery industry-“inflation is the grocer’s friend”-indicates the positive influence inflation can have for our business if we manage our inventory and purchasing properly. We can be assured that our competitors are attempting to take full advantage of this opportunity.

Types of retail growth

Achieving $5 billion in sales by 2020 will require an increased emphasis on expansion and new stores. It is unlikely that this rate of growth can be achieved by today’s 137 NCGA member storefronts. There are five primary types of retail growth strategy and they each offer varying degrees of potential and risk. If we find value in growing our market share over the next 12 years, we will have to consider all of our alternatives, and our individual co-op growth strategies will include a blend of these five options.

Often the simplest avenue for increasing a store’s sales is an expansion of the current facility. Many co-ops have successfully employed this strategy. There is little risk in such an expansion, since the store is able to build upon the current customer base and sales volume. We normally see sales growth begin to slow in our facilities as annual sales approach $1,000 per square foot. This sales level approaches or reaches the limitations of the physical space relative to the ease of shopping the store and the overall staff and customer experience. There are exceptions to this, but they are few. We can generally use the “50 percent rule” when considering expansions of current facilities: apply 50 percent of the current sales per square foot to the additional space to project our post-expansion gain in sales volume.

Many of our stores are not able to expand their current facilities, due to the limitations of the site, and must consider other options for growth. A second option is to relocate that facility to a larger location. This is another option that many of our co-ops have chosen over the years, with great success. If we are able to locate a suitable facility that is within the store’s current trade area, then we again are able to build upon the current customer and sales base with very little risk. As we move further away from our current trade area, the risk of losing some of our existing sales base increases. Much of today’s sales growth is being driven by growth in prepared foods, fresh meat and seafood, cheese, dairy and frozen food departments. Expanded space provides the opportunity to increase our offerings in these key departments. Additional sales are most easily achieved by increased variety and choice for customers in the departments driving today’s growth.

The third option for growth is to open additional stores outside of our current trade area. This option presents increased risk, since we must build sales from new customers who may not be familiar with our cooperative experience. A number of co-ops have successfully expanded into new markets, but it is important that we are able to meet these new customers and potential co-op members “where they are.” Our current business and membership has been built over many years. We have worked hard at educating our communities about the value of our alternative economic model. Today’s much higher new store costs require higher sales levels to operate profitably. If we consider new markets, we must make it easy for new customers to get to know us and not permit our practices to create barriers for new communities that shop with us, while they learn about us and consider the value of co-op membership.

It is important to note that there are strong differences of opinion about the value of this growth strategy. Many feel that a co-op must grow from the community and that we cannot create a co-op by just opening a new store. My experience suggests the opposite. I believe that communities are hungry for the values we bring to the operation of our businesses-integrity and transparency. We operate for the benefit of our stakeholders. We need to earn a profit, but our profits are returned to members and reinvested in the business and community. These are tangible differences that can be felt in our stores. We do have to work to earn new business, but we have worked and continue to work to earn today’s business as well.

An additional growth option, and another new store strategy, is the acquisition of existing food stores. This option often carries less risk than new stores, since we are able to build upon the existing store’s business. We will normally pay a premium for this reduced risk, but the business is in place with inventory, equipment and trained staff. There are many independent food store owners looking for an exit strategy. I strongly encourage co-ops considering additional locations to explore this option. Many communities are losing their only locally owned food store. What better way to maintain local ownership than community ownership? The key to acquisitions of this nature is to get them before they close. It is important to be considering potential acquisition candidates and to contact them regarding our interest in their business should they decide to sell.

The highest risk growth we see today exists for new co-op start ups. The cycle times are long, and today’s high cost of building, equipment and inventory often prohibit new co-ops from opening. Those that do are often burdened with greater debt than the business can service. New startups also often find it difficult to attract the necessary talent to operate the store successfully. These factors have combined to create a very high failure rate for new start up co-ops over the past five years. It is much easier for current co-ops with existing capital, cash flow, systems, and talent to grow than for startups to open and operate successfully. The Food Co-op 500 program is working to address these challenges, but much work remains to create a sustainable co-op startup program.

These are all viable methods to achieving increased rates of growth in our sector. We may not find the increased prominence and relevance that will result from a larger share of market compelling enough for us to consider all these options. But we may find value in the additional service and value to our communities that growth provides.

To take a key example, many of our co-ops are actively engaged in the support of local and regionally produced products, and many of our local producers are under extreme economic pressure. All of their costs are increasing dramatically, and they must either grow their sales or raise their prices to remain in business. Many local products are already significantly more expensive than the nationally distributed counterparts. While our customers and co-op members do find value in paying a premium for locally produced goods, at what point will this value begin to erode as the premium increases?

Most of our co-ops play a very important role in the economic health of their local producers. We are already engaging in a great deal of community economic development as we work to maintain and build our regional food supply or food-sheds. In order to sustain and grow this system over time, we must build additional sales volume for these products. I personally believe that this endeavor offers the most compelling reason for our continued expansion and sales growth. We can have an impact in rebuilding our regional food supply, but economies of scale are vital to the success of our local producers just as they are for our business. If our local producers are important to our business, then their success becomes vital to our success. As we are able to enter new markets with additional locations, we also build new markets for our local products. This creates a powerful and productive partnership between our retail business and the community at large.

Each of the 109 National Cooperative Grocers Association members is an independent, community-owned cooperative. Each cooperative decides for itself what value growth may provide the cooperative and what ends growth may help it to achieve. It is certain that individual co-ops will find different reasons to grow and will choose different options for that growth as they think best. As our cooperatives have grown and matured over the years, we are demonstrating greater success in our ability to grow when we so choose. Our business systems continue to improve, our staff members’ business knowledge is expanding, and our systems to support growth are also improving. Whatever value we each find in growing our cooperatives, our options for growth and the potential for success have never been greater.C.E. Pugh is national development director for the National Cooperative Grocers Association and formerly was general manager of LaMontanita Cooperative ([email protected]).