Human Resources Survey

This is the second annual Cooperative Grocer Human Resources (HR) Survey report. It has been expanded to include information about boards of directors and members of co-ops, information that was formerly included in the Retail Operations Survey (published in the July-August CG).

Thanks to the many talented people who helped with the survey design and analysis: Carolee Colter, Kate Sumberg, Ruffin Slater, Darcy Klasna, Brad Salmon, Marilyn Scholl, Bill Gessner, and Mel Braverman.

Reported by Store Size: Upper Quartile / Median / Lower Quartile

Large

Medium Large

Medium Small

Small

UQMedianLQ UQMedianLQ UQMedianLQ UQMedianLQGeneral Manager35.5332.2126.70 21.6220.6720.05 20.7918.4417.43 16.6314.4211.30Store Manager23.0021.2520.34 17.6317.3016.28 16.3515.0012.75 10.609.588.38Finance24.7921.7319.22 18.2117.7014.47 15.5013.5512.50 11.7910.508.00Marketing19.2017.6815.84 15.1913.2412.64 12.5011.5011.00 11.5910.5010.00Merchandising22.2018.4717.84 16.7613.1012.03 12.6311.6310.56 10.639.507.63Office14.7413.3712.85 13.9011.609.48 12.5510.609.99 10.008.507.00Membership16.4814.7413.12 13.8313.089.75 11.5010.009.33 10.508.007.25Human Resources19.8618.6417.66 16.5114.9713.20 13.2612.0010.13 13.3110.509.50Data Processing20.1517.0914.42 13.1012.0010.00 12.0010.009.99 10.8810.259.25Front End17.9515.5014.27 13.2012.8712.00 13.0012.0010.75 10.008.507.50Grocery17.9416.4615.15 14.1613.0012.05 13.0012.5011.39 9.618.257.50Deli21.9418.3715.64 14.3513.1012.50 12.4911.5010.00 9.508.507.75Meat18.4316.8215.50 13.7711.0011.00 12.1311.0010.00 8.887.756.88Produce17.5716.5015.96 14.9313.5310.70 12.5011.5010.93 10.8510.007.50HABA16.8816.0714.91 13.5813.0812.00 13.0011.5010.50 10.509.008.13General Merch.15.9015.6014.55 14.9313.0511.35 12.0010.009.99 9.258.006.88

Introduction

This report is organized under the following headings:

- Major findings

- Survey methodology

- Basic HR parameters and pay issues

- Employee benefits

- Member labor

- Staff education/training and profit sharing

- Board compensation and composition

- Policy Governance

- Co-op membership

- Notes

The Cooperative Grocer HR Survey is designed to help co-ops evaluate HR and compensation practices. Last year’s HR Survey was published in CG #93, March-April 2001. Because this is the second annual comprehensive HR survey, it has allowed us to track change in co-op practices in this area.

Major findings

• Employee turnover: Turnover rates for co-ops overall rose to a median of 65% from last year’s median of 60%. With the current estimated cost of replacing an employee calculated to be over $6,000, this change is significant.

• Salary or wage:The significant variation in both the number of salaried positions and the percent of salaried positions compare to staff size merits further research about the productivity and capacity impact of salaried positions.

• Pay for payroll services: The cost for payroll services varied greatly and was not predictable according to store size or other known factors. While the cost of this service is affected by the particular levels of service that a co-op purchases, the variations account for thousands of dollars per year. It may be useful to explore these differences and also explore ways to minimize the cost of contracting for payroll services.

• Departmental breakdown – data breakdown:The departmental hourly wages information collected this year did not appear to be statistically reliable. Because of this uncertainty, we have chosen not to publish new figures but instead, for the convenience of readers, have included last year’s table.

Survey methodology

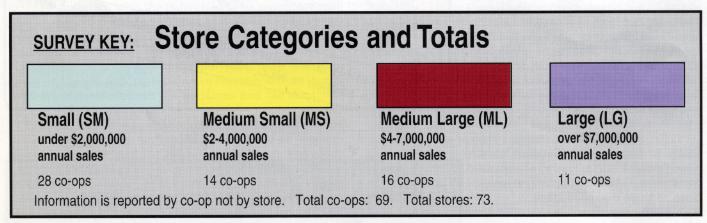

This year, 69 cooperatives with 73 stores responded to the Cooperative GrocerHuman Resources Survey. The responses came from 32 states. As with any survey, especially a fairly detailed one such as ours, some responses were incomplete and some sections were filled out incorrectly, so totals may not reflect the entire set. In some cases, where corollary information was available, estimates were made to fill in the blanks. The CoCoFiSt database, which includes many of the HR survey respondents, was also used to complete portions of some surveys and for some of the analysis.

For most responses we have provided medians and quartiles. Often more useful than mean (or average) figures, the median divides a population in half, while the quartiles reflect the upper and lower one-fourth. The median figure is not influenced by extremely large or small values as is the mean. The upper quartile (UQ) reflects the point marking exactly one quarter from the top number, and the lower quartile (LQ) is the number from the population exactly one quarter from the bottom.

Basic HR parameters and pay issues

Management structure: 90 percent of the cooperatives reporting indicate that they operate with a general manager. Four cooperatives use a co-manager system and three co-ops use a management team as top management.

Unions: 6 of 69 cooperatives reporting on this item indicate that they are unionized. None of the small co-ops is unionized.

Payroll services: About half of cooperatives reporting, prepare payroll in-house, and the other half contract with ADP, Paychex or another payroll service. The larger the cooperative is, the more likely it is that is uses as payroll service.

Here are the percentagesof each size that send their payroll out: SM: 35%; MS: 50%; ML: 44%; LG: 80%.

Payroll service fees varied greatly. The median annual amount spent on payroll services was $3,250, with a LQ of $2,325 and UQ of $5,390: a very large range. The fees varied so much that we looked at individual co-op surveys and noticed that the variance in the costs did not seem to be related either to the size of the co-op or the number of employees at a co-op.

While we recognize there are significant factors that affect pricing of payroll services, it occurred to us that co-ops in other sectors have used their joint purchasing power to drive this expense down. Perhaps food o-ops also could benefit by negotiating with a payroll service to reduce this expense.

Payroll periods: 51% of co-ops pay every other week, 25% pay on the 1st and 15th, and 22 pay weekly. Interestingly, the percentage of co-ops that do payroll weekly is declining.

Full Time/Part Time: The median number of weekly hours worked to be considered a full time employee is 32 hours, and 53% of employees are considered to be full time. The median number of weekly hours worked to be considered part time is 20 hours. These numbers were the same last year.

LG stores tend to have more full time employees: SM stores had 40% full time and 60% part time while LG were just the opposite at 62% full time and 38% part time. ML and SM were about the same at slightly under 50% full time and slightly over 50% part time employees.

Average Number of Employees and Salaried Positions: The median number of employees in a typical week for small stores is 16. For Medium Small stores the median number of employees is 37. Medium Large stores have a median of 61 employees in a week, and for Large stores the median is 125 employees in a typical week.

The median number of salaried positions varied with the size of the co-op. Large co-ops had a median of 13 salaried positions and Medium Large stores reported 6.5. Medium Small stores had a median of 4.5 salaried positions and Small co-ops had 2 salaried positions.

The percent of salaried employees compared to the average number of employees in a given week varied widely. If the average weekly payroll is 40 employees and 10 of them are salaried employees, the percent of salaried employees would be 25%. For Large stores that range was 6-14%; the Medium Large range was 3-25%, Medium Small stores range from 2-31%, and for Small stores the range was from 3-25%.

Employee turnover: As a gauge of turnover, Carolee Colter suggests using the total number of employee separations for a year divided by the average number of people on payroll. Using this ratio, the median co-op turnover rate in 2001 was 65%, up from the 60% reported the previous year.

We noted again the median turnover rate increases with the size of the store and is twice as large at 96% for Large stores as it is for Small stores at 47%. In fact, the median turnover rate was lowest for the Small stores at 47%, grew to 70% for MS stores, to 88% for ML stores and was 96% for Large stores. Traditionally cashiers and deli staff have the highest turnover rate, so product mix and large numbers of cashiers in larger stores might explain this correlation between size and turnover.

Employee benefits

Included with this report is a chart on Margin Minus Labor (MML) and how taxes and benefits affect it. MML compares gross margin and labor by reducing the variations that occur as a result of large deli and bakery departments or other specific causes. This chart shows that the Large stores have the highest MML without taxes and and benefits. But because of their high benefit costs, their MML is not the highest when taxes and benefits are included.

Paid Time Off (PTO): This category includes vacation, holiday, sick, and any personal days. See the accompanying chart on “Paid Time Off.”

For full time employees the median days off are 12 in the first year, 15.5 days during year two, 20 days for 2 to 3 years, 20 days for 3 to 4 years, and 24 days for more than 4 years of tenure at the co-op.

Part time employees received fewer days off in general, with median days off at 5.5 in the first year and 6 in years two and three, 9 days for 3 to 4 years, and 9.5 for over 4 years. Interestingly, LG stores tend to offer fewer days off to their part time employees than ML or MS co-ops, and to their full time employees fewer days off in their first year of employment.

During the first few years of employment, store size does not seem to matter much in terms of paid time off. However, this changes as an employee’s tenure at the co-op lengthens: co-op staff in large stores tend to receive a few more days. By the fourth year, large store staff receive about 25% more days off then small store staff.

The larger the store, the more likely it is that paid time off will accumulate rather than expire each: 38% of Small co-ops all accumulation, while 58% of MS, 66% of ML, and 70% of LG do.

Health and Dental Insurance: Health and dental benefits were distinguished between full time and part time employees.

For full time employees, 84% of co-ops contribute to a median of 90% of the premium costs for single coverage and a median of 50% for both dependent and family coverage. These figures are lower than last year, when the median coverage of a single premium cost for full time employees was 100%, and the dependent and family plan premium costs had median co-op contributes of 72.5% and 70.0%. This suggests that co-ops are asking their employees to share in this growing expense.

(Note: The data is a little confusing, because some co-ops offer single person, dependent, and family options, while other co-ops offer just a single plan and a family plan which encompasses the dependent plan structure. This makes the data a little hard to compare precisely.)

Several co-ops stated that they pay a fixed amount per employee and arrange to have family and dependent insurance available. A majority of the larger sized co-ops pay some portion of dependent and family benefits, as compared to a minority of the MS and SM co-ops.

As with other benefits, the larger the co-op, the more likely staff will be offered health and dental insurance, and the higher the percent the co-op pays toward the premium.

For part time employees, the percent of staff covered and the percent of premium covered deteriorate rapidly. Half of the co-ops reporting offer coverage to their part time employees, and several co-ops report that they must wait a year for coverage to be available to them. Median coverage drops to 50% for single and family coverage, and the median for dependent coverage is 53%. The percent of premium covered varies but in general declines in smaller co-ops.

In 2001, 61% of co-ops offering health insurance also offered dental insurance. This is slightly up compared to 2000. Of the co-ops that offer dental insurance, 51% make it available to their part time employees. Again, large stores offered significantly more and higher benefits to part-timers.

Providers: approximately 90% of health and dental insurance is provided through an insurance company.

Other benefits: Retirement plans are offered by 48% of the co-ops reporting. Only 14% of SM co-ops offer some type of plan, but 100% of LG co-ops do. 69% of ML and 43% of MS offered some type of plan. Of these, 48% of the plans are 401Ks and 39% are SIMPLE IRAs. One co-op offers a SEP. With a single exception, all of the Large co-ops reporting offered 401K plans.

All of the co-ops with retirement plans contributed to them either through a contribution or a match. The medians for co-op match and co-op contribution both were 3% of wages.

From those reporting on vesting schedules for their retirement plans, the median requirement was 6 years to fully vested. Some 35% of co-ops offered pre-tax Salary Reduction Plans.

Disability insurance was being carried at 20 co-ops. Five of these co-ops carried both long-term and short-term coverage. The median percent of income covered by the benefit was 60% and the median length of the benefit was 26 weeks. 35% of all co-ops reported that they offer some form of life insurance to their employees.

Only 9% of the co-ops reported that they provide Employee Assistance Programs. The monthly cost ranged from $1.51-$2.05 per employee.

Employee purchase discounts were offered pretty much across the board, and most co-ops didn’t distinguish between full time and part time for this benefit. The median was 15% for both. There was a lot of variation, however: the high employee discount on purchases was 34% and the low was 8%.

Member labor

Approximately 70% of co-op respondents report that they have a member work program. While 86% of Small stores have member work programs, only 45% of Large stores do. ML and MS stores came in at 63% and 64%.

For all co-ops, the median number of member workers, the amount of work, and the discount amount were:

• for 25 weekly workers, 2 hours of work for a 15% discount;

• for 31 monthly workers, 5 hours of work for a 10% discount.

Using these medians, in a given week there would be a median of 32 members working 86 hours in a typical co-op.

The median member labor discount as a percent of gross sales was 1%.

Staff education/training and profit sharing

Some 56% of co-ops reported on profit sharing, along with staff education and training. The profit sharing median for all co-ops was .2% (.002) of gross sales, with a LQ of 0% and an UQ of 1.51%. As in other areas this benefit increased as store size increased. The range of this benefit was 0-1.5% for the ML and Large stores and from 0-1.4% for the small and MS co-ops. Overall, there was a decrease in profit sharing percent compared with the 2000 profit sharing median for all co-ops of .6%.

Investment in staff education and training (other than training new hires) was reported as a percent of payroll. The median was .8% of payroll. Medium Small and Small stores had the highest median investment in staff education/training at 1.40% and 1.00%, respectively.

Board compensation and composition

Co-op directors receive compensation in purchase discounts and in stipends. 85% of co-ops reporting provided their board members with purchase discounts, with a median value of 15%. About 20% of co-ops reported giving board members stipends, with a median amount of $420 per year (up from $360 last year). Eight co-ops report that they give stipends to all board members in addition to a discount on purchases. Nine co-ops provided a different stipend to their board chair, and that median was $930 per year (up from $710 last year).

Board composition and meetings: 78% of reporting co-ops allow employees to serve on the board. Of these director positions available to employees, 85% are elected by members, 11% are elected by employees, and 4% are appointed positions.

The median numbers suggest a nine member board of directors with 3-year terms and 12 meetings per year.

Eight co-ops reporting have appointed board seats. While the median is two seats, two co-ops have completely appointed boards of 7 and 9 members.

Annual board training and planning: 60% of co-ops responding to this question reported that they have an annual board planning retreat, and 60% have an annual training session.

Policy Governance

Survey questions pertaining to Policy Governance were more detailed than last year’s. 61% of respondents reported that the board of directors is using Policy Governance.

Respondents were also asked to describe how the board has been using Policy Governance. Some 51% of the co-ops said they have been using Policy Governance for over 2 years; 26% reported Policy Governance use for two years or less; and 23% chose the statement, “We have begun the implementation process but have not really started using Policy Governance.”

Seven descriptive statements: Questions about board performance were included in the survey, and respondents were asked to choose answers that most closely reflected their perception of the board’s performance. Reply choices were: Yes (high performing), Not fully (medium), No (minimal performance), and N/A (don’t know).

The descriptive statements rated were:

- Board agenda and discussions are primarily at the policy values level.

- A framework of policies in four categories is in place and used regularly.

- Board adheres to its policies and respects and honors its delegation to GM.

- Board monitors GM performance rigorously and only against policy criteria.

- Board ensures good governance through recruitment, orientation and training.

- The board has linkages with member owners.

- The board initiates and is in charge of its own work.

Four of these seven statements received opinion ratings of medium to high performance from most of the respondents. The statement, “Board agenda and discussions are primarily at the policy/values level” was rated as a high performing area by 55% of the respondents.

Co-op membership

Members and Percent Sales to Members: Comparing the number of members in 2000 to the same store numbers for 2001 revealed a 9% increase. This increase was not evenly distributed across stores sizes. ML stores enjoyed a 16% increase in members, SM and LG stores were at 7% and 8% respectively, and MS stores lost about 1% of their members.

The percent of gross sales to members was about the same as last year in each store size category. Large stores averaged 65% of sales to members, 70% for the ML stores, 40% for the MS, and 55% for Small stores. The median percent of gross sales to members was 53%.

Member voting and annual meeting attendance: An average of 9.5% of members voted in the most recent board elections, with a median of 8.5% and a range of 2-50%. Co-op respondents reported on attendance at their annual meeting: the median attendance was 45 members. Comparing the number of attendees to total number of members for 60 co-ops, we found that 2% of members attended their co-op’s annual meeting last year.

Mail ballots: 77% of responding co-ops allow ballots to be dropped off or mailed. The percentage by co-op size: S: 77%; MS: 54%; ML: 93%; LG: 91%.

Patronage refunds: Six co-ops reported that they gave a patronage refund last year. The median refund was .5% of sales and the range was .32-3.01%.

This year we asked for information about discounts given to members that are not working member discounts. What we learned is that nearly two-thirds of the co-ops responding give a discount at the register. The median discount is 5%, and the range is 1-10%. There were qualifications to this discount for several co-ops, ranging from “5% every day and 10% on Tuesdays” to “discount is given on one purchase per month to a max. of $3.50.” One co-op reported a 15% surcharge for nonmembers.

Member Financial Requirements: 91% of co-op respondents listed their membership financial requirements. Of those, 78% reported a refundable investment, 20% collected annual fees, and 10% reported that they require both. Most co-ops provide for a payment plan, and the median annual equity requirement under such plans was $20.37.

Further details about member equity payment plans: the length of time allowed for payment plans varies from four months to 10 years. Several co-ops mentioned that they are reviewing their member equity/dues structure.

Member equity requirements for individuals were a median of $95 with a LQ of $60 and an UQ of $150. For household membership, median equity was $120 with a LQ of $90 and an UQ of $180.

Member fee requirements for an individual were a median of $1750/year with a LQ of $15 and an UQ of $20. Household fees were a median $15/year with a LQ of $12 and an UQ of $20.

Notes

The amount of time required to take this survey varied also. The reported median was 1.5 hours with a LQ of 12 minutes and an UQ of 6 hours.

We have several ideas for improving the usefulness of this survey for next year. Your suggestions are appreciated!

Here are some valuable sources we used in preparing this report:

- www.salary.com Cost of Living Wizard enables you to compare cost of living between cities

- http://stats.bls.gov/oco/ocos116.htm U.S. Department of Labor, Bureau of Labor Statistics

- www.progressivegrocer.com Sjupermarket industry trade journal with articles about industry trends

- www.gourmetretailer.com Gourmet industry trade journal with store operations annual report

- www.newhope.com Natural Foods Merchandiserreports

- trfic.umn.edu The Retail Food Industry Center

- www.fmi.org The Food Marketing Institute