Ratios Rectified—and a Rebate Request

Alert readers Joe Golton from Ashland Food Co-op and John Foley from Outpost Natural Foods Co-op found mistakes in the Return on Equity and the Return on Assets ratios in the Operations Report table. They each have received a CWPPPA (Coveted White Plastic Pocket Protector Award) and were asked to serve on the Cooperative Grocer analysis team for next year’s report.

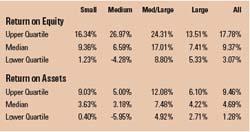

Corrected numbers for Return on Equity and Return on Assets ratios have been posted on the website at www.cooperativegrocer.coop and also are shown in the sidebar below. The correct data shows higher ratios than was originally reported in the ratios table in this year’s Operations Survey (p. 22 of Cooperative Grocer #113, July–August 2004). My apologies for the mistake.

While discussing the error, we also had a good talk about averages and weighted averages that I’d like to share with you. This approach was briefly mentioned in the original report. Here’s a fuller explanation.

Weighty matters

The burning issue, surely of interest to co-op data analyzers, is whether the numbers should represent the “average” of results or the “weighted average” of the results. We use both in the report.

The income statement and balance sheet tables are weighted averages. For example, when we calculate the margin, the gross profit dollars for all stores are added and then divided by total sales dollars for all stores. In the “All” category, the largest single store’s gross profit dollars will be more than the smallest store’s, and will therefore “count” more in the reflected gross margin weighted average. Of course, the large store’s gross profit dollars do not influence the weighted average gross margin for the “Small” category, but the largest small store’s gross profit dollars will.

For the ratios section, we use the median, rather than the weighted average. To calculate gross margin for this section, we take all of the gross margin percentages (not gross profit dollars), sort them from highest to lowest, and pick the middle one. In this case both the Wedge Co-op and Bisbee Food Co-op count the same.

The two approaches yield different results. The median gross margin and the weighted average gross margin for the “All” category are 36.45 percent and 37.36 percent, respectively.

Which is better? Well, both are useful, and together they paint a more complete picture than either one alone. The weighted averages treat us like a virtual chain and allow us to more easily and accurately compare our results to those of our chain competitors such as Whole Foods and Wild Oats. The medians, on the other hand, are better for comparing among ourselves. For example, how does my margin compare to other co-ops my size?

Check your chart of accounts!

One other issue arose in our discussion. We need your help on this one. We’d like to report “return on equity” and “return on assets” using “net income before patronage rebates to members.” To do this, we are requesting that all co-ops that provide patronage rebates add a patronage rebate expense line to the co-op’s chart of accounts and show patronage rebates as an expense.

Many co-ops already do so, but some accountants have advised co-ops that patronage rebates are adjustments to the equity section of the balance sheet and do not appear in the income statement (that’s the way stock dividends are handled by public companies). But in a consumer cooperative, patronage rebates should be treated as an operating expense, according to a Supreme Court ruling—and that is why customer cooperative patronage rebates are not taxed. Other co-ops post patronage rebates to “Other Expenses,” so we can’t tell if a patronage rebate has been issued.

If all co-ops adopted the practice of posting patronage rebates to a patronage rebate expense account, it would improve our comparisons in this area and better enable us to compare to our competition as well. The CoCoPocketProtectors will take this issue up at our next meeting. Any co-op who switches will receive a CWPPPA!